Calgary, Alberta, February 10, 2026: Inter Pipeline Ltd. (“Inter Pipeline”) today announced its preliminary unaudited results for the three and twelve-month periods ended December 31, 2025.

“Inter Pipeline delivered record results in 2025, driven by strong operating performance across our businesses, new long-term commercial agreements, and continued momentum at Heartland,” said Paul Hawksworth, President and Chief Executive Officer. “Our cash flows remain resilient as we added additional cost-of-service and fee-based contracts. With a disciplined approach to capital allocation, we are well positioned to advance capital-efficient growth opportunities that extend our integrated value chain.”

|

|

Three Months Ended December 31 |

Twelve Months Ended December 31 |

||

|

CAD$ millions, unaudited |

2025 |

2024 |

2025 |

2024 |

|

Net (loss) income |

$ (1.5) |

$ 22.7 |

$ 15.2 |

$ (170.4) |

|

Gross profit |

$ 442.2 |

$ 409.1 |

$ 1,756.9 |

$ 1,513.4 |

|

Adjusted EBITDA(1) |

$ 385.4 |

$ 360.7 |

$ 1,546.1 |

$ 1,382.5 |

|

Funds From Operations(1) |

$ 258.2 |

$ 237.3 |

$ 1,059.7 |

$ 875.6 |

(1)Non-GAAP financial measure. Please refer to the “Specified Financial Measures” section of this news release.

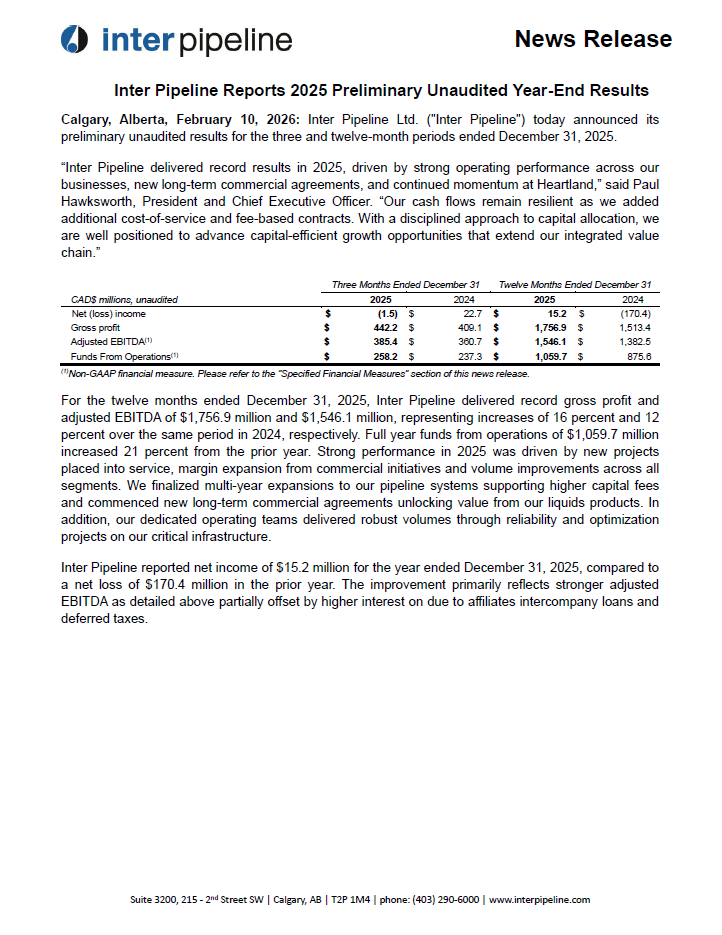

For the twelve months ended December 31, 2025, Inter Pipeline delivered record gross profit and adjusted EBITDA of $1,756.9 million and $1,546.1 million, representing increases of 16 percent and 12 percent over the same period in 2024, respectively. Full year funds from operations of $1,059.7 million increased 21 percent from the prior year. Strong performance in 2025 was driven by new projects placed into service, margin expansion from commercial initiatives and volume improvements across all segments. We finalized multi-year expansions to our pipeline systems supporting higher capital fees and commenced new long-term commercial agreements unlocking value from our liquids products. In addition, our dedicated operating teams delivered robust volumes through reliability and optimization projects on our critical infrastructure.

Inter Pipeline reported net income of $15.2 million for the year ended December 31, 2025, compared to a net loss of $170.4 million in the prior year. The improvement primarily reflects stronger adjusted EBITDA as detailed above partially offset by higher interest on due to affiliates intercompany loans and deferred taxes.

Breakdown by Segments

Gross profit generated by each of Inter Pipeline’s reportable segments for the three and twelve months ended December 31 is as follows:

|

|

Three Months Ended December 31 |

Twelve Months Ended December 31 |

||

|

CAD$ millions, unaudited |

2025 |

2024 |

2025 |

2024 |

|

Transportation(1) |

$ 265.5 |

$ 275.8 |

$ 1,036.0 |

$ 1,005.8 |

|

Facilities Infrastructure(1) |

69.5 |

39.2 |

212.7 |

133.0 |

|

Marketing(1) |

73.5 |

66.3 |

334.5 |

263.0 |

|

Heartland(1) |

27.5 |

33.8 |

164.3 |

127.7 |

|

Corporate(1) |

6.2 |

(6.0) |

9.4 |

(16.1) |

|

Gross profit |

$ 442.2 |

$ 409.1 |

$ 1,756.9 |

$ 1,513.4 |

(1)Includes intersegment transactions or intersegment eliminations.

Adjusted EBITDA generated by each of Inter Pipeline’s reportable segments for the three and twelve months ended December 31 is as follows:

|

|

Three Months Ended December 31 |

Twelve Months Ended December 31 |

||

|

CAD$ millions, unaudited |

2025 |

2024 |

2025 |

2024 |

|

Transportation(2) |

$ 254.7 |

$ 247.5 |

$ 978.5 |

$ 945.2 |

|

Facilities Infrastructure(2) |

51.8 |

36.3 |

186.3 |

122.1 |

|

Marketing(2) |

62.6 |

70.7 |

290.8 |

265.3 |

|

Heartland(2) |

24.9 |

25.6 |

131.0 |

114.8 |

|

Corporate(2) |

(8.6) |

(19.4) |

(40.5) |

(64.9) |

|

Adjusted EBITDA(1) |

$ 385.4 |

$ 360.7 |

$ 1,546.1 |

$ 1,382.5 |

(1)Non-GAAP financial measure. Please refer to the “Specified Financial Measures” section of this news release.

(2)Includes intersegment transactions or intersegment eliminations.

Our Transportation segment generated gross profit of $1,036.0 million and adjusted EBITDA of $978.5 million, which was up 3 percent and 4 percent, respectively, compared to the prior year. Results benefited from the partial year contribution from the Narrows Lake and BlackGold projects which were placed into service mid-year, lower operating expenses and optimization activities. Our commissioned capital projects are underpinned by stable, long-term agreements with high quality counterparties and will continue to provide reliable cash flows.

The Facilities Infrastructure segment generated gross profit of $212.7 million and adjusted EBITDA of $186.3 million, representing year-over-year increases of 60 percent and 53 percent, respectively. The strong financial performance was driven by the commencement of new commercial arrangements and higher throughput volumes at Cochrane while debottleneck initiatives in the prior year resulted in improved product recoveries in our Offgas business.

Inter Pipeline’s Marketing segment delivered strong results in 2025, supported by record sales volumes and a disciplined approach to value capture for our NGL products. Marketing generated gross profit of $334.5 million, a 27 percent increase over prior year, and adjusted EBITDA of $290.8 million or a 10 percent increase over 2024. Inter Pipeline continues to focus on de-risking Marketing cash flows though placing products in premium markets and hedging.

Heartland delivered new operating milestones and achieved record polypropylene sales of 840.2 million lbs for 2025, a 14 percent increase from the previous year despite softer market conditions. Adjusted EBITDA was $131.0 million, an increase of $16.2 million, or 14 percent. The facility continues to run at conservative operating rates with focus on stability and longevity while progressing margin improvement initiatives. Heartland’s structurally advantaged, low-cost feedstock position and strong contractual profile enhance stability through commodity cycles.

Update on Strategic Initiatives

In 2025, Inter Pipeline advanced its growth strategy through disciplined execution and a continued focus on enhancing the quality and durability of cash flows. Three major projects including Narrows Lake, BlackGold, and Blackrod were placed into service on schedule and under budget. These projects highlight our strategy to expand our footprint while leveraging existing pipeline infrastructure to support the delivery of critical energy products to market hubs. The company executed long-term arrangements to diversify sales channels and sell our liquids products to premium markets. Our focus on operational excellence translated to higher product recoveries, sales volumes, and reliability across the business. In 2026, Inter Pipeline will remain focused on capital-efficient growth, disciplined cost management, strong operational performance at Heartland and accretive commercial opportunities that enhance long-term value. Furthermore, we remain committed to our investment grade rating and maintaining a strong balance sheet as we advance these strategic priorities.

About Inter Pipeline Ltd.

Inter Pipeline is a world-scale energy infrastructure business headquartered in Calgary, Alberta Canada and engaged in the transportation, processing, marketing and storage of commodities and petrochemical products across Western Canada and Europe. www.interpipeline.com

Contacts

|

Investor Relations: |

Media Relations: |

|

Todd James |

Steven Noble |

|

General Manager, Treasury, Commodity & Financial Risk |

Manager, Corporate Communications |

|

Email: todd.james@interpipeline.com |

Email: mediarelations@interpipeline.com |

|

Tel: 403-290-2689 |

Tel: 403-717-5725 or 1-866-716-7473 |

Reader Advisories and Cautionary Statements

Currency

All dollar values are expressed in Canadian dollars unless otherwise noted.

Preliminary Unaudited Financial Information

The financial and operating results included in this news release are based on preliminary unaudited estimated results which have not yet been finalized or, in the case of annual results, audited. These estimated results are subject to change upon completion of the financial statements for the year ended December 31, 2025 and the audit of such financial statements, and such changes could be material due to, among other things, the completion of Inter Pipeline’s financial closing procedures, final adjustments, review by Inter Pipeline’s auditors and other developments that may arise between now and the time the financial results are finalized. Accordingly, such estimated results are forward-looking statements (as defined below) within the meaning of applicable securities legislation and are subject to the limitations and risks described under “Forward-Looking Statements” below.

Inter Pipeline anticipates filing its audited annual financial statements for the year ended December 31, 2025 and related management’s discussion and analysis on SEDAR+ at sedarplus.ca in March 2026.

Forward-Looking Statements

Certain information contained herein may constitute forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of applicable securities legislation that involve known and unknown risks, assumptions, uncertainties and other factors. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expects” and similar expressions. Readers are cautioned not to place undue reliance on forward-looking statements, including, but not limited to, statements with respect to Inter Pipeline’s anticipated year-end 2025 financial results including for each of its business segments and results disclosed in the body of this news release and in the accompanying unaudited consolidated financial statements, the quality of Inter Pipeline’s cash flows, the belief that Inter Pipeline is well positioned to advance capital-efficient growth opportunities extending its integrated value chain, the anticipated benefits to be realized from the Narrows Lake and BlackGold projects including that they will continue to provide reliable cash flow contributions, Inter Pipeline’s plans to continue to focus on de-risking Marketing cash flows though placing products in premium markets and hedging, the belief that Heartland’s structurally advantaged, low-cost feedstock position and strong contractual profile enhance stability through commodity cycles, Inter Pipeline’s plan to remain focused on capital-efficient growth, disciplined cost management, strong operational performance at Heartland and accretive commercial opportunities that support long-term value creation, the commitment to the investment grade rating and maintaining a strong balance sheet as Inter Pipeline advances strategic priorities, other statements contained under the heading “Update on Strategic Initiatives” and the anticipated timing for filing audited annual financial statements. Such statements reflect the current views of Inter Pipeline with respect to future events and are subject to certain risks, uncertainties and assumptions that could cause the results of Inter Pipeline to differ materially from those expressed in the forward-looking statements. Factors that could cause actual results to vary from forward-looking statements or may affect the operations, performance, development and results of Inter Pipeline’s businesses include, among other things: risks and assumptions associated with operations, such as Inter Pipeline’s ability to successfully implement its strategic initiatives and achieve expected benefits therefrom, including the further development of its pipeline systems and other facilities or projects; assumptions concerning operational reliability; Inter Pipeline’s ability to maintain its investment grade credit ratings; assumptions based upon Inter Pipeline’s internal guidance including projected future adjusted EBITDA levels; the ability to access sufficient capital from internal and external sources including debt capital; risks inherent in Inter Pipeline’s Canadian and foreign operations; Inter Pipeline’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the potential delays of and costs of overruns on construction projects, including, but not limited to Inter Pipeline’s current and future projects; risks associated with the failure to finalize formal agreements with counterparties in certain circumstances; Inter Pipeline’s ability to make capital investments and the amounts of capital investments; increases in maintenance, operating or financing costs; the realization of the anticipated benefits of transactions; the availability and price of labour, equipment and construction materials; the status, credit risk and continued existence of customers having contracts with Inter Pipeline and its affiliates; availability of energy commodities; volatility of and assumptions regarding prices of energy commodities; competitive factors, including competition from third parties in the areas in which Inter Pipeline operates or intends to operate, pricing or inflationary pressures and supply and demand in the natural gas, propane and oil transportation, natural gas liquids extraction and storage industries; supply chain disruptions; fluctuations in currency and interest rates; inflation; risks of war, hostilities, civil insurrection, pandemics, instability and political and economic conditions in or affecting countries in which Inter Pipeline and its affiliates operate; severe weather conditions and risks related to climate change; terrorist threats; risks associated with technology; changes in laws and regulations, including environmental, regulatory and taxation laws, and the interpretation of such changes to Inter Pipeline’s business; the risks associated with existing and potential or threatened future lawsuits, legal proceedings and regulatory actions against Inter Pipeline and its affiliates; availability of adequate levels of insurance; difficulty in obtaining necessary regulatory approvals or land access rights and maintenance of support of such approvals and rights; and general economic and business conditions and markets; and such other risks and uncertainties described from time to time in Inter Pipeline’s reports and filings with the Canadian securities authorities. The impact of any one assumption, risk, uncertainty, or other factor on a forward-looking statement cannot be determined with certainty, as these are interdependent and Inter Pipeline’s future course of action depends on management’s assessment of all information available at the relevant time. You can find a discussion of those risks and uncertainties in Inter Pipeline’s most recent annual MD&A under the section “Risk Factors” and in Inter Pipeline’s other securities filings at www.sedarplus.ca. As actual results could vary significantly from the forward-looking statements, you should not put undue reliance on forward-looking statements. Such information, although considered reasonable by Inter Pipeline at the time of preparation, may later prove to be incorrect and actual results may differ materially from those anticipated in the statements made. For this purpose, any statements that are not statements of historical fact are deemed to be forward-looking statements. The forward-looking statements contained in this news release are made as of the date of this document, and, except to the extent required by applicable law, Inter Pipeline assumes no obligation to update or revise forward-looking statements made herein or otherwise, whether as a result of new information, future events, or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary note.

Specified Financial Measures

This news release contains various specified financial measures such as “non-GAAP financial measures” as such term is defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure (“NI 52-112”). Further information concerning non-GAAP financial measures used in this news release are set forth below.

Non-GAAP Financial Measures

The non-GAAP financial measures used in this news release are not standardized financial measures under GAAP and might not be comparable to similar measures presented by other companies where similar terminology is used. Investors are cautioned that non-GAAP financial measures should not be construed as alternatives to or more meaningful than the most directly comparable GAAP measures as indicators of Inter Pipeline’s performance. Set forth below is a description of the non-GAAP financial measures used in this news release.

The following non-GAAP measures are provided to assist investors with their evaluation of Inter Pipeline, including their assessment of its ability to generate cash. Management considers these specified financial measures to be important indicators in assessing its performance.

Adjusted EBITDA and funds from operations are reconciled from gross profit, which is the most directly comparable GAAP measure. Adjusted EBITDA is calculated as gross profit (a component of net income) less general and administrative costs, excluding unrealized gain/loss on derivatives and non-recurring items that may not be reflective of ongoing business performance. Non-recurring items includes certain non-cash provisions, unrealized gain/loss on foreign currency, and one-time costs. FFO also includes additional adjustments to remove current income taxes and non-affiliated financing costs, and to add back non-cash items.

The following table reconciles gross profit to adjusted EBITDA and FFO:

|

Three Months Ended December 31 |

||||||||||||

|

CAD$ millions, unaudited |

Transportation |

Facilities Infrastructure |

Marketing |

Heartland |

Corporate(1) |

Total |

||||||

|

|

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

|

Gross profit (loss)(1) |

$ 265.5 |

$ 275.8 |

$ 69.5 |

$ 39.2 |

$ 73.5 |

$ 66.3 |

$ 27.5 |

$ 33.8 |

$ 6.2 |

$ (6.0) |

$ 442.2 |

$ 409.1 |

|

General and administrative costs |

28.3 |

20.0 |

3.4 |

2.9 |

3.4 |

3.7 |

9.7 |

2.5 |

17.0 |

11.6 |

61.8 |

40.7 |

|

EBITDA(1) |

237.2 |

255.8 |

66.1 |

36.3 |

70.1 |

62.6 |

17.8 |

31.3 |

(10.8) |

(17.6) |

380.4 |

368.4 |

|

Unrealized gain (loss) on derivatives |

— |

— |

— |

— |

8.4 |

(8.5) |

— |

— |

— |

0.1 |

8.4 |

(8.4) |

|

Non-recurring items |

(17.5) |

8.3 |

14.3 |

— |

(0.9) |

0.4 |

(7.1) |

5.7 |

(2.2) |

1.7 |

(13.4) |

16.1 |

|

Adjusted EBITDA(1) |

$ 254.7 |

$ 247.5 |

$ 51.8 |

$ 36.3 |

$ 62.6 |

$ 70.7 |

$ 24.9 |

$ 25.6 |

$ (8.6) |

$ (19.4) |

$ 385.4 |

$ 360.7 |

|

(1)Includes intersegment transactions or intersegment eliminations. (2)Net of non-recurring items. |

Less: |

|

|

|||||||||

|

Current income taxes |

0.8 |

3.0 |

||||||||||

|

Financing charges |

117.2 |

116.0 |

||||||||||

|

Non-cash recovery(2) |

9.2 |

4.6 |

||||||||||

|

Non-recurring financing costs |

— |

(0.2) |

||||||||||

|

Funds from operations |

$ 258.2 |

$ 237.3 |

||||||||||

|

Twelve Months Ended December 31 |

||||||||||||

|

CAD$ millions, unaudited |

Transportation |

Facilities Infrastructure |

Marketing |

Heartland |

Corporate(1) |

Total |

||||||

|

|

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

2025 |

2024 |

|

Gross profit (loss)(1) |

$1,036.0 |

$1,005.8 |

$212.7 |

$133.0 |

$334.5 |

$263.0 |

$164.3 |

$127.7 |

$9.4 |

$(16.1) |

$1,756.9 |

$1,513.4 |

|

General and administrative costs |

71.7 |

78.6 |

12.3 |

11.0 |

17.7 |

13.4 |

47.8 |

30.7 |

53.7 |

50.4 |

203.2 |

184.1 |

|

EBITDA(1) |

964.3 |

927.2 |

200.4 |

122.0 |

316.8 |

249.6 |

116.5 |

97.0 |

(44.3) |

(66.5) |

1,553.7 |

1,329.3 |

|

Unrealized gain (loss) on derivatives |

— |

— |

— |

— |

30.5 |

(16.6) |

— |

— |

— |

0.4 |

30.5 |

(16.2) |

|

Non-recurring items |

(14.2) |

(18.0) |

14.1 |

(0.1) |

(4.5) |

0.9 |

(14.5) |

(17.8) |

(3.8) |

(2.0) |

(22.9) |

(37.0) |

|

Adjusted EBITDA(1) |

$ 978.5 |

$ 945.2 |

$186.3 |

$ 122.1 |

$290.8 |

$265.3 |

$131.0 |

$114.8 |

$(40.5) |

$(64.9) |

$1,546.1 |

$ 1,382.5 |

|

(1)Includes intersegment transactions or intersegment eliminations. (2)Net of non-recurring items. |

Less: |

|

|

|||||||||

|

Current income taxes |

2.7 |

4.0 |

||||||||||

|

Financing charges |

463.5 |

476.8 |

||||||||||

|

Non-cash recovery(2) |

20.2 |

31.4 |

||||||||||

|

Non-recurring financing costs |

— |

(5.3) |

||||||||||

|

Funds from operations |

$1,059.7 |

$ 875.6 |

||||||||||

Inter Pipeline Ltd.

Consolidated Balance Sheets

|

|

As at |

|

|

(unaudited)(millions of Canadian dollars) |

December 31 |

December 31 |

|

2025 |

2024 |

|

|

|

|

|

|

ASSETS |

|

|

|

Current Assets |

|

|

|

Cash and cash equivalents

|

$ 37.3 |

$ 404.4 |

|

Restricted cash |

— |

1.0 |

|

Accounts receivable |

486.3 |

515.0 |

|

Current income taxes receivable |

1.9 |

2.3 |

|

Prepaid expenses and other assets |

52.2 |

42.7 |

|

Inventory |

98.8 |

115.2 |

|

Derivatives |

14.6 |

0.8 |

|

Total Current Assets |

691.1 |

1,081.4 |

|

|

|

|

|

Non-Current Assets |

|

|

|

Property, plant, and equipment |

14,115.2 |

13,096.2 |

|

Goodwill and intangible assets |

4,858.4 |

5,101.1 |

|

Right-of-use assets |

299.2 |

304.4 |

|

Derivatives |

2.5 |

— |

|

Other long-term assets |

16.3 |

19.2 |

|

Deferred income taxes |

11.1 |

8.8 |

|

Total Assets |

$ 19,993.8 |

$ 19,611.1 |

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

Current Liabilities |

|

|

|

Accounts payable and other liabilities |

$ 475.2 |

$ 561.2 |

|

Lease liabilities |

38.9 |

37.8 |

|

Derivatives |

1.3 |

17.3 |

|

Current income taxes payable |

2.1 |

2.8 |

|

Short-term debt and current portion of long-term debt |

1,584.7 |

1,448.3 |

|

Total Current Liabilities |

2,102.2 |

2,067.4 |

|

|

|

|

|

Non-Current Liabilities |

|

|

|

Long-term debt |

7,673.5 |

7,945.5 |

|

Due to affiliates |

3,315.0 |

3,620.6 |

|

Long-term lease liabilities |

301.1 |

305.8 |

|

Provisions |

148.9 |

144.3 |

|

Long-term deferred revenue and other liabilities |

40.0 |

29.5 |

|

Deferred income taxes |

1,799.1 |

1,536.8 |

|

Total Liabilities |

15,379.8 |

15,649.9 |

|

|

|

|

|

Total Equity |

4,614.0 |

3,961.2 |

|

Total Liabilities and Equity |

$ 19,993.8 |

$ 19,611.1 |

Consolidated Statements of Net Income (Loss)

|

|

Years Ended December 31 |

|

|

(unaudited)(millions of Canadian dollars) |

2025 |

2024 |

|

|

|

|

|

Revenue |

$ 4,261.4 |

$ 4,631.9 |

|

Cost of sales |

2,537.4 |

3,056.2 |

|

(Gain) loss on derivatives |

(32.9) |

62.3 |

|

GROSS PROFIT |

1,756.9 |

1,513.4 |

|

|

|

|

|

Depreciation and amortization |

835.2 |

835.0 |

|

Financing charges |

463.5 |

476.8 |

|

Interest on due to affiliates |

234.0 |

228.5 |

|

General and administrative |

203.2 |

184.1 |

|

INCOME (LOSS) BEFORE INCOME TAXES |

21.0 |

(211.0) |

|

|

|

|

|

Income tax expense (recovery) |

5.8 |

(40.6) |

|

NET INCOME (LOSS) |

$ 15.2 |

$ (170.4) |

Consolidated Statements of Comprehensive Income (Loss)

|

|

Years Ended December 31 |

|

|

(unaudited)(millions of Canadian dollars) |

2025 |

2024 |

|

|

|

|

|

NET INCOME (LOSS) |

$ 15.2 |

$ (170.4) |

|

|

|

|

|

OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

Items that may be reclassified subsequently to net income |

|

|

|

Unrealized gain on translating financial statements of foreign operations |

31.5 |

2.6 |

|

Gain on cash flow hedges, net of tax |

1.4 |

— |

|

Item that will not be reclassified to net income |

|

|

|

Increase (decrease) in revaluation surplus, net of tax |

845.1 |

(14.7) |

|

Other Comprehensive Income (Loss) |

878.0 |

(12.1) |

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS) |

$ 893.2 |

$ (182.5) |

Consolidated Statements of Cash Flows

|

|

Years Ended December 31 |

|

|

(unaudited)(millions of Canadian dollars) |

2025 |

2024 |

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

Net income (loss) |

$ 15.2 |

$ (170.4) |

|

Items not involving cash: |

|

|

|

Depreciation and amortization |

835.2 |

835.0 |

|

Non-cash recovery |

(22.5) |

(26.8) |

|

Increase in due to affiliates |

33.0 |

170.5 |

|

Deferred income tax expense (recovery) |

3.1 |

(44.6) |

|

Unrealized (gain) loss on derivatives |

(30.5) |

16.2 |

|

Net change in non-cash operating working capital |

(17.9) |

(72.1) |

|

Cash provided by operating activities |

815.6 |

707.8 |

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

Expenditures on property, plant, and equipment |

(435.3) |

(441.1) |

|

Net change in non-cash investing working capital |

(26.5) |

(7.7) |

|

Cash used in investing activities |

(461.8) |

(448.8) |

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

Cash dividends paid on common shares |

(240.4) |

— |

|

Principal payments on lease liabilities |

(39.7) |

(34.1) |

|

Repayment of due to affiliates |

(338.6) |

— |

|

Net issuance (repayment) of short-term borrowings including transaction costs |

322.6 |

(42.8) |

|

Issuance of long-term borrowings including transaction costs |

— |

445.7 |

|

Repayment of long-term borrowings |

(425.0) |

(500.0) |

|

Cash used in financing activities |

(721.1) |

(131.2) |

|

|

|

|

|

Effect of foreign currency translation on cash |

0.2 |

0.8 |

|

(Decrease) increase in cash and cash equivalents |

(367.1) |

128.6 |

|

Cash and cash equivalents, beginning of year |

404.4 |

275.8 |

|

Cash and cash equivalents, end of year |

$ 37.3 |

$ 404.4 |

|

|

|

|

|

Cash taxes paid |

$ 3.1 |

$ 2.9 |

|

Cash interest paid including interest on due to affiliates |

$ 702.5 |

$ 559.6 |

Consolidated Statements of Changes in Equity

|

|

Share |

|

|

Total |

|

(unaudited)(millions of Canadian dollars) |

Capital |

Earnings |

AOCI(1) |

Equity |

|

Balance, January 1, 2025 |

$ 4,077.2 |

$ (106.3) |

$ (9.7) |

$ 3,961.2 |

|

Net income for the year |

— |

15.2 |

— |

15.2 |

|

Other comprehensive income |

— |

— |

878.0 |

878.0 |

|

Dividends declared |

— |

(240.4) |

— |

(240.4) |

|

Balance, December 31, 2025 |

$ 4,077.2 |

$ (331.5) |

$ 868.3 |

$ 4,614.0 |

|

|

|

|

|

|

|

Balance, January 1, 2024 |

$ 4,077.2 |

$ 64.1 |

$ 2.4 |

$ 4,143.7 |

|

Net loss for the year |

— |

(170.4) |

— |

(170.4) |

|

Other comprehensive loss |

— |

— |

(12.1) |

(12.1) |

|

Balance, December 31, 2024 |

$ 4,077.2 |

$ (106.3) |

$ (9.7) |

$ 3,961.2 |

- Accumulated Other Comprehensive Income (“AOCI”)