CALGARY, AB, June 10, 2021 /CNW/ – Inter Pipeline Ltd. (“Inter Pipeline” or the “Company”) (TSX: IPL) today reconfirms that the Board of Directors (the “Board”) unanimously recommends that Shareholders support the strategic share-exchange transaction with Pembina Pipeline Corporation (“Pembina”) and reject the revised hostile takeover offer (the “Revised Brookfield Offer”) proposed by an affiliate of Brookfield Infrastructure Partners L.P. (“Brookfield”).

The Board’s determination followed careful consideration, including advice from its financial and legal advisors, and the recommendation of a special committee of independent directors (the “Special Committee”). To reject the Revised Brookfield Offer, simply take NO ACTION. If you have tendered your Shares in error and wish to withdraw, simply ask your broker or contact Kingsdale Advisors (see contact information below) to assist you with this process.

“The proposed combination with Pembina provides Inter Pipeline shareholders the ability to participate in a large, highly integrated energy infrastructure business with significant potential growth opportunities across the value chain, including additional future cash flow from the Heartland Petrochemical Complex,” said Margaret McKenzie, Chair of the Board and the Special Committee. “The strategic combination with Pembina supports an immediate increase in dividend yield and the ability to participate in meaningful anticipated commercial and operational synergies. In addition, following our thorough analysis, we expect the intrinsic value of this business combination to be in excess of $19.45 per share for Inter Pipeline shareholders, and superior to the Revised Brookfield Offer.”

A Notice of Change to Directors’ Circular (the “Notice of Change”) providing the full details concerning the Board’s recommendation, including the reasons to APPROVE the strategic combination with Pembina and REJECT the Revised Brookfield Offer and the background to both offers is available on the Company’s website at www.interpipeline.com and at www.sedar.com. The Notice of Change is also being mailed to all persons required to receive a copy under applicable securities laws.

The Notice of Change also includes a Letter to Shareholders summarizing the reasons why Shareholders should APPROVE the strategic combination with Pembina and REJECT the Revised Brookfield Offer. The full text of the Letter to Shareholders is provided here:

Dear Fellow Shareholder,

The board of directors (the “Board”) of Inter Pipeline Ltd. (“Inter Pipeline” or the “Company”) unanimously recommends that you approve an all share combination with Calgary-based Pembina Pipeline Corporation (“Pembina”). Under the terms of the Arrangement Agreement with Pembina (the “Arrangement Agreement”), for each Inter Pipeline Common Share (the “Common Shares”) that you own, you would receive 0.5 of a Pembina Common Share (the “Exchange Ratio”) by way of a statutory plan of arrangement pursuant to the Business Corporations Act (Alberta) (the “Pembina Arrangement”).

The Special Committee and the Board believe the Pembina Arrangement is superior to the alternative proposed by an affiliate of Brookfield Infrastructure Partners L.P. (“Brookfield”) – a revised hostile takeover offer (the “Revised Brookfield Offer”) under which Brookfield proposes to buy your shares for cash, shares of Brookfield Infrastructure Corporation (“BIPC”), or for eligible electing Shareholders, units of Brookfield Infrastructure Corporation Exchange Limited Partnership (“Exchange LP”), or a mix of cash, BIPC shares and/or Exchange LP units, as applicable. The attached Notice of Change to Directors’ Circular (“Notice of Change”) includes a summary of the Revised Brookfield Offer under the heading “Notice of Change to Directors’ Circular”.

The Board is of the view that retained ownership in the combined entity resulting from the Pembina Arrangement will provide you with greater value, underpinned by both the combined business’ synergies, growth prospects, dividends and future investment opportunities. Moreover, the Pembina Arrangement offers you the opportunity to continue to benefit from the future value of Inter Pipeline’s existing business, with Shareholders holding approximately 28% ownership of the combined entity.

We urge you to carefully read the attached Notice of Change, which provides the complete list of reasons to APPROVE the Pembina Arrangement and REJECT the Revised Brookfield Offer. Meanwhile, here in summary form are some of the factors the Board considered in reaching these recommendations.

1. The consideration under the Pembina Arrangement has an implied value, which is greater than the value of the Revised Brookfield Offer

Due to the strategic nature of the Pembina Arrangement (including significant expected synergies and strong combined growth prospects), and Shareholders’ expected approximate 28% ownership of the combined entity, the intrinsic value of the Pembina Arrangement is expected to be in excess of the $19.45 per Common Share ‘headline’ value of the Exchange Ratio (the “Headline Value”), and higher than the value of the Revised Brookfield Offer.

The Board is confident that the value of the consideration will grow over the long term, more than offsetting any minor variations in the value of the consideration due to temporary and expected market fluctuations that are likely to arise prior to the expiry of the Revised Brookfield Offer.

As noted in the table below, the value of the Pembina Arrangement consists of the Headline Value (being the closing price of the Pembina Common Shares on May 31, 2021 multiplied by the Exchange Ratio of 0.5) plus the value of the expected synergies. Together, this combination makes the value of the Pembina Arrangement greater than the value of the Revised Brookfield Offer.

|

Transaction |

Value per Common Share Based on May |

|

Board-Supported Pembina Arrangement

|

Headline $19.45 per Share

Headline Value PLUS $0.65-0.75(1) per Share per $100 Million per Year of Synergies |

|

Revised Brookfield Offer |

$19.42(2)

($19.21(3), Assuming the Shareholder Receives 100% Share Consideration) |

|

(1) |

Per every $100 million increment of potential synergies; assuming a 10 to 12x valuation multiple. The incremental value per share estimate is calculated by multiplying $100 million by 10 to 12x and dividing the product by approximately 765 million Pembina Common Shares that are expected to be outstanding following completion of the Pembina Arrangement, and multiplying the quotient by the Exchange Ratio of 0.5. |

|

(2) |

Estimate calculated reflecting the pro rata value of the Revised Brookfield Offer of $5.56 billion of cash, 23.0 million BIPC Shares valued at BIPC’s closing price of $85.35 on May 31, 2021, divided by 387.4 million Inter Pipeline Common Shares not owned by Brookfield. |

|

(3) |

Estimate based on an exchange ratio of 0.225 multiplied by BIPC’s closing price of $85.35 per share on May 31, 2021. |

Pembina has publicly disclosed the potential for meaningful near and longer-term synergies from the Pembina Arrangement. As holders of Pembina Common Shares following the completion of the Pembina Arrangement, Shareholders who retain Pembina Common Shares will participate in the value of such synergies to the extent realized.

Also, Inter Pipeline Shareholders under the Pembina Arrangement will retain, as holders of Pembina Common Shares, an implicit 28% interest in the Heartland Petrochemical Complex (“HPC”), which is expected to provide material upside with $400 to $450 million of EBITDA in 2023 (the first full year of operations) and $450 to $500 million of long-term EBITDA annually. Under the Revised Brookfield Offer, the upside to you from HPC (and from Inter Pipeline’s other assets) may not be available or would be so diluted as to be unnoticeable.

The combined business resulting from the Pembina Arrangement is also expected to accelerate and de-risk accretive investment opportunities across various value chains, allowing for the opportunity to deploy capital into projects at attractive rates of return. In addition, the combination is expected to be accretive to long term cash flow, providing Inter Pipeline Shareholders with meaningful share price upside potential.

2. The Pembina Arrangement supports an immediate increase in dividends payable to Shareholders post-closing, as well as long-term dividend growth potential in the combined company

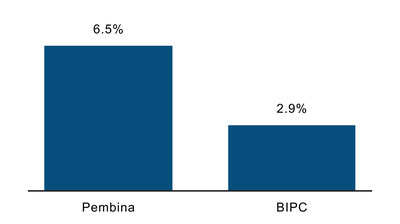

Pembina’s dividend yield is significantly higher than Brookfield’s. Shareholders who receive BIPC Shares or Exchangeable LP Units under the Revised Brookfield Offer would receive lower dividends than they would from the combined company following completion of the Pembina Arrangement. Moreover, Brookfield’s dividend is only payable quarterly, whereas Pembina and Inter Pipeline dividends are payable monthly. Canadian residents will also be subject to currency exposure on each dividend payment as dividends on BIPC Shares are declared in U.S. dollars.

Pembina Has a Higher Dividend Yield than Brookfield

Note: Dividend yield as of May 31, 2021. Based on Pembina’s guidance of a $0.23 per month dividend following the successful commission and start-up of HPC, Pembina’s dividend yield would be 7.1%.

If you retain Pembina Common Shares pursuant to the Pembina Arrangement, you will have the opportunity to participate in future dividend growth on Pembina Common Shares. Upon closing of the Pembina Arrangement, you would benefit from an immediate 175% increase to your current monthly dividend of $0.04 per Common Share, assuming an increase in the Pembina dividend to $0.22 per Pembina Common Share, as well as a further increase of $0.01 to the monthly dividend which Pembina has confirmed its intention to implement following the successful commissioning and in-service date of HPC. Furthermore, Pembina has a strong track record of consistent dividend increases.

3. Pembina Common Shares have highly attractive characteristics

Holders of Inter Pipeline Common Shares will become shareholders in one of the largest Canadian midstream companies with a ~$29 billion equity market capitalization and ~$52 billion enterprise value. Pembina Common Shares historically have been, and post-transaction are expected to continue to be, highly liquid securities. As a result, the consideration provided in the Pembina Arrangement provides immediate liquidity to Shareholders should they wish to monetize the Pembina Common Shares received. The Pembina Common Shares historically have had more trading liquidity than the BIPC Shares and more than the Common Shares.

The exchange of Common Shares for Pembina Common Shares can be completed on a fully tax-deferred basis for Canadian resident Shareholders. However, while the Revised Brookfield Offer does provide a tax-deferred option for certain Canadian Shareholders wishing to accept its exchangeable unit alternative, most Shareholders will not benefit from a tax-deferred exchange to the extent they elect to receive cash or are otherwise limited by proration to the amount of exchangeable units received. Depending on a Shareholder’s tax basis in Common Shares held and form of consideration received, the Revised Brookfield Offer could result in lower after-tax value received at closing than the tax-deferred Pembina Arrangement. U.S. resident Shareholders also may be eligible for a tax deferred rollover in connection with the Pembina Arrangement.

4. The Pembina Arrangement was the result of a full and fair strategic review process and is supported by all of Inter Pipeline’s directors

The Pembina Arrangement was determined to be the preferred strategic alternative available to Inter Pipeline and its Shareholders following the conclusion of Inter Pipeline’s thorough Strategic Review, which was conducted by a special committee of independent directors (the “Special Committee”) and included advice from financial advisors, TD Securities and J.P. Morgan, and legal counsel, BDP and Dentons.

Following receipt of confidential information, Brookfield and all other interested parties were provided multiple opportunities to put forward an offer that would be compelling for Shareholders and that would receive Inter Pipeline Board support.

Brookfield was notified on May 31, 2021, that Inter Pipeline was prepared to accept a competing en bloc proposal with market standard deal protection provisions, including a “break fee”. Brookfield’s response to this notification was to deliver a further revised proposal that, in the view of the Special Committee, was still inferior to the Pembina Arrangement.

“Break fees” are a customary deal protection feature in transactions similar to the Pembina Arrangement and the quantum of the break fee in the Pembina Arrangement is within the range of market precedents for transactions of this nature. Furthermore, break fees tend to be higher for transactions announced following a thorough auction process (similar to Inter Pipeline’s Strategic Review).

5. Provisions in the Pembina Arrangement Agreement materially reduce the risk to closing Due to regulatory matters

The Arrangement Agreement with Pembina contains favourable provisions which require Pembina to assume the risk of any regulatory delay or remedy under the Competition Act and close the Pembina Arrangement in a timely manner. These “hell or high water” provisions protect the interests of Shareholders by limiting the ability of Pembina to delay closing of the Pembina Arrangement due to ongoing regulatory review.

We believe that meaningful challenges are unlikely due to the complementary nature of Inter Pipeline and Pembina’s operations, and are advised by our legal counsel that these provisions in the Arrangement Agreement reduce the risk to closing of a transaction with Pembina.

6. TD Securities and J.P. Morgan have provided fairness opinions in respect of the Pembina Arrangement.

APPROVE the Pembina Arrangement and REJECT the Revised Brookfield Offer

For the reasons fully described in the attached Notice of Change, the Inter Pipeline Board UNANIMOUSLY recommends that Shareholders APPROVE the Pembina Arrangement and REJECT the Revised Brookfield Offer.

Inter Pipeline Shareholder Meeting

Further information regarding the Pembina Arrangement will be contained in a joint information circular that Inter Pipeline and Pembina will prepare, file and mail in due course to their respective shareholders in connection with the meetings for the Inter Pipeline Shareholders and the holders of Pembina Common Shares scheduled to be held on July 29, 2021. The Pembina Arrangement is currently expected to close late in the third quarter or early in the fourth quarter of 2021. The joint information circular will contain the details concerning the Pembina Arrangement, the Arrangement Agreement and the support of the Special Committee and the Board for the Pembina Arrangement.

To reject the Revised Brookfield Offer, simply take NO ACTION. If you have tendered your Common Shares in error and wish to withdraw, simply ask your broker or contact Kingsdale Advisors for assistance. You can reach Kingsdale Advisors at 1-877-659-1820 (416-867-2272 for collect calls outside North America) or by e-mail at contactus@kingsdaleadvisors.com. For more information, please go to www.interpipeline.com.

On behalf of the Board and the Special Committee, I would like to thank you for your consideration and your support.

Signed

Margaret McKenzie

Chair of the Board and the Special Committee of Inter Pipeline

About Inter Pipeline Ltd.

Inter Pipeline is a major petroleum transportation and natural gas liquids processing business based in Calgary, Alberta, Canada. Inter Pipeline owns and operates energy infrastructure assets in Western Canada and is building the Heartland Petrochemical Complex — North America’s first integrated propane dehydrogenation and polypropylene facility. Inter Pipeline is a member of the S&P/TSX 60 Index and its common shares trade on the Toronto Stock Exchange under the symbol IPL. www.interpipeline.com

Contact Information

Investor Relations:

Jeremy Roberge

Vice President, Finance and Investor Relations

Email: investorrelations@interpipeline.com

Tel: 403-290-6015 or 1-866-716-7473

Media Relations:

Breanne Oliver

Corporate Spokesperson

Email: mediarelations@interpipeline.com

Tel: 587-475-1118 or 1-866-716-7473

Disclaimer

Certain information contained herein may constitute forward-looking statements that involve risks and uncertainties. Readers are cautioned not to place undue reliance on forward-looking statements, including, but not limited to, statements regarding the Pembina Arrangement, including the anticipated benefits thereof to Pembina’s and Inter Pipeline’s respective shareholders relative to the Revised Brookfield Offer; the anticipated timing of closing of the Pembina Arrangement; the potential tax impact associated with the Revised Brookfield Offer; the anticipated future liquidity of and dividends payable on the Pembina Common Shares and the BIPC Shares, respectively; the expected size, efficiency, valuation, project certainty and capacity of the combined company; the effect of the Pembina Arrangement on competition in the industries in which Pembina and Inter Pipeline do business; the combined company’s capacity and opportunities to expand and pursue and develop new projects and investments, as well as the anticipated size, timing and impacts of such projects and investments; future dividends, including increases in the amounts thereof, which may be declared on the Pembina’s Common Shares; the anticipated synergies associated with the Pembina Arrangement (including strategic integration and diversification opportunities and the accretion to cash flow of Pembina) and the expected size, sources, timing and effects thereof; the ongoing utilization and expansions of, and additions to, the combined company’s business and asset base, growth and growth potential; financial results related to growth and expansion opportunities associated with the assets of the combined company; the announcement of proprietary growth opportunities by Pembina; HPC, including its anticipated impact on the combined company’s financial position and potential future petrochemical projects; the expected Canadian and U.S. tax treatment of the Pembina Arrangement; and the magnitude and allocation of any closing and regulatory risks associated with the Pembina Arrangement; and the forwarding-looking statements and financial outlooks contained in the Letter to Shareholders and the Notice of Change under the heading “Cautionary Statement on Forward-Looking Statements” and “Financial Outlooks”. Factors that could cause actual results to vary from forward-looking statements or may affect the operations, performance, development and results of Inter Pipeline’s businesses include, among other things, the ability of the parties to satisfy the conditions to closing of the Pembina Transaction in a timely manner and substantially on the terms described in this press release; risks and assumptions associated with operations, including: the further development of its projects and facilities; assumptions concerning operational reliability; the potential delays of and increased costs of construction projects (including HPC) and future expansions of Inter Pipeline’s assets; the realization of the anticipated benefits of acquisitions and other projects Inter Pipeline is developing; the timing, financing and completion of acquisitions, transactions or other projects Inter Pipeline is pursuing including the Pembina Transaction; risks inherent in Inter Pipeline’s Canadian and foreign operations; risks associated with the failure to finalize formal agreements with counterparties in circumstances where letters of intent or similar agreements have been executed and announced by Inter Pipeline; Inter Pipeline’s ability to generate sufficient cash flow from operations to meet its current and future obligations; Inter Pipeline’s ability to maintain its current level of cash dividends to its shareholders; Inter Pipeline’s ability to access sources of debt and equity capital; Inter Pipeline’s ability to make capital investments and the amounts of capital investments; Inter Pipeline’s ability to maintain its credit ratings; the availability and price of labour, equipment and construction materials; the status, credit risk and continued existence of counterparties having contracts with Inter Pipeline and its affiliates and their performance of such contracts; competitive factors, pricing pressures and supply and demand in the oil and gas transportation, natural gas liquids processing and bulk liquid storage industries; increases in maintenance, operating or financing costs; availability of adequate levels of insurance; difficulty in obtaining necessary regulatory approvals or land access rights and maintenance of support of such approvals and rights; risks of war, hostilities, civil insurrection, instability and political and economic conditions in or affecting countries in which Inter Pipeline and its affiliates operate; severe weather conditions and risks related to climate change; terrorist threats; risks associated with technology and cyber security; availability of energy commodities; volatility of and assumptions regarding prices of energy commodities; fluctuations in currency and interest rates; changes in laws and regulations, including environmental, regulatory and taxation laws, and the interpretation of such changes to Inter Pipeline’s business; the risks associated with existing and potential or threatened future lawsuits and regulatory actions against Inter Pipeline and its affiliates; general economic and business conditions; the effects and impacts of the COVID-19 pandemic as further described in Inter Pipeline’s reports and filings, the extent and duration of which are uncertain at this time, on Inter Pipeline’s business and general economic and business conditions and markets, and such other risk factors, assumptions and uncertainties described from time to time in Inter Pipeline’s reports and filings with the Canadian securities regulatory authorities including in the Notice of Change and in Inter Pipeline’s most recent MD&A and Annual Information Form, and other documents it files from time to time. You can find these documents by referring to Inter Pipeline’s profile on SEDAR (www.sedar.com). Such information, although considered reasonable by Inter Pipeline at the time of preparation, may later prove to be incorrect and actual results may differ materially from those anticipated in the statements made. For this purpose, any statements that are not statements of historical fact are deemed to be forward-looking statements. The forward-looking statements contained in this news release are made as of the date of this news release, and, except to the extent required by applicable law, Inter Pipeline assumes no obligation to update or revise forward-looking statements made herein or otherwise, whether as a result of new information, future events, or otherwise. The forward-looking statements contained in this news release are expressly qualified by this cautionary note.

Non-GAAP Financial Measures

The Letter to Shareholders contains references to EBITDA which is not a measure recognized by GAAP. This non-GAAP financial measure does not have a standardized meaning prescribed by GAAP and therefore may not be comparable to similar measures presented by other entities. Investors are cautioned that this non-GAAP financial measure should not be construed as an alternative to other measures of financial performance calculated in accordance with GAAP such as net income. EBITDA is expressed as net income before financing charges, income taxes, depreciation and amortization; adjusted EBITDA also includes additional adjustments for loss (gain) on disposal of assets, non-cash expense (recovery), and non-cash financing charges. These additional adjustments are made to exclude various non-cash items, or items of an unusual nature that are not reflective of ongoing operations. These adjustments are also made to better reflect the historical measurement of EBITDA used in the investment community as an approximate measure of an entity’s operating cash flow based on data from its income statement. See the Company’s most recent MD&A for an example of the reconciliation of EBITDA net income. See also “Non-GAAP Financial Measures” in the Notice of Change.

Currency

All dollar values are expressed in Canadian dollars unless otherwise noted.

SOURCE Inter Pipeline Ltd.