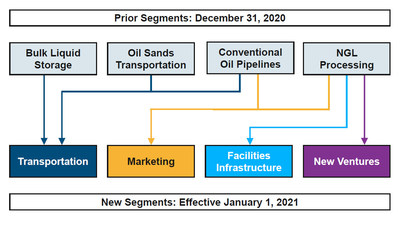

CALGARY, AB, April 8, 2021 /CNW/ – Inter Pipeline Ltd. (“Inter Pipeline”) (TSX: IPL) announced today it will report first quarter 2021 operating and financial results under a new business structure to align with how it manages budgets and commercially operates its business. Inter Pipeline was previously organized into four businesses: oil sands transportation, conventional oil pipelines, NGL processing and bulk liquid storage. Effective January 1, 2021, these four segments have been repositioned into four new segments: transportation, facilities infrastructure, marketing and new ventures.

Planned in early 2020, and approved by the Board in October, the reorganization integrates similar assets and contract structures thereby maximizing operational efficiencies. The new structure will also streamline external reporting and promote alignment with Inter Pipeline’s energy infrastructure peers. A centralized and integrated marketing division has been established to aggregate commodity-based adjusted EBITDA, while handling commodity risk management and hedging activities. Additional benefits include enhancing transparency with cost-of-service and fee-based adjusted EBITDA generated by the transportation and facilities infrastructure segments and providing a platform for the integration of large-scale new business ventures, such as HPC.

“Since becoming a public entity in 1997, Inter Pipeline has experienced tremendous growth through the development and expansion of our oil sands transportation, conventional oil pipelines and NGL processing business segments,” said Christian Bayle, Inter Pipeline’s President and Chief Executive Officer. “Given the enhanced scale of our business, the ongoing integration of the Heartland Petrochemical Complex and the changing nature of the energy industry, the time was right for Inter Pipeline’s structure to further adapt to position us for continued long-term success.”

The following diagram summarizes the changes to the business segments and further details are outlined in a presentation available on Inter Pipeline’s website at: www.interpipeline.com

Transportation Business

Inter Pipeline’s transportation segment is comprised of oil sands and conventional oil pipeline systems, as well as bulk liquid storage terminals. These infrastructure assets generate adjusted EBITDA that is underpinned by stable cost-of-service and fee-based contracts. Midstream marketing activities are completed by the marketing segment for fixed service fees. In total, Inter Pipeline operates six pipeline systems with ultimate capacity to transport over five million barrels per day of petroleum products from producing sites in Alberta and Saskatchewan. Additionally, Inter Pipeline operates bulk liquid storage terminals in Denmark and Sweden, which includes approximately 19 million barrels of storage capacity across eight terminals.

Facilities Infrastructure Business

The facilities infrastructure segment owns and operates assets that provide customers with NGL, offgas and petrochemical products and services. Adjusted EBITDA from this business is generated by cost-of-service and fee-based arrangements. Commodity based products are sold to the marketing segment for fixed service fees. NGL and offgas fractionation is provided through interests in three Alberta straddle plants at Cochrane and Empress, as well as an integrated offgas business that includes the Redwater Olefinic Fractionator, Pioneer I and Pioneer II processing facilities located near Fort McMurray, Alberta and the Boreal pipeline that connects these facilities.

Marketing Business

Inter Pipeline’s marketing segment manages the logistics and sale of products not produced under fee-based or cost-of-service agreements, as well as engaging in facility and pipeline optimization opportunities. The objective is to maximize the value of Inter Pipeline’s petroleum, petrochemical, olefinic and paraffinic products while reducing the volatility associated with market-based product sales. Adjusted EBITDA and operational results are subject to a variety of factors including commodity prices, volume fluctuations and differentials. The marketing segment is also responsible for Inter Pipeline’s commodity risk management activities, including hedging.

New Ventures Business

The new ventures segment focuses on the development of large-scale innovative projects to create new cash flow streams, while better serving Inter Pipeline customers through enhanced services or market access. Inter Pipeline’s new ventures business currently includes the Heartland Petrochemical Complex, a world-scale integrated complex with one of the lowest greenhouse gas emissions footprints in the world for producing polypropylene. Polypropylene is a high value, easily transported, recyclable plastic used in the manufacturing of an extensive range of finished products and consumer goods, such as packaging, textiles, automobile components, healthcare products and medical supplies.

First Quarter 2021 Financial Results Conference Call and Webcast

Inter Pipeline will announce its first quarter 2021 financial and operating results on May 6, 2021. A conference call and webcast has been scheduled for May 7, 2021 at 11:00 a.m. MT (1:00 p.m. ET) for interested shareholders, analysts and media representatives.

To participate in the conference call, please dial 1 (888) 231-8191. The conference ID is 9870355. A replay of the conference call will be available until May 14, 2021 by calling 1 (855) 859-2056. The code for the replay is 9870355.

A live audio webcast of the conference call will be accessible on Inter Pipeline’s website at www.interpipeline.com, and a replay of the webcast will be available for approximately 90 days.

About Inter Pipeline Ltd.

Inter Pipeline is a major petroleum transportation and natural gas liquids processing business based in Calgary, Alberta, Canada. Inter Pipeline owns and operates energy infrastructure assets in Western Canada and is building the Heartland Petrochemical Complex — North America’s first integrated propane dehydrogenation and polypropylene facility. Inter Pipeline is a member of the S&P/TSX 60 Index and its common shares trade on the Toronto Stock Exchange under the symbol IPL. www.interpipeline.com

Contact Information

Investor Relations:

Jeremy Roberge

Vice President, Finance and Investor Relations

Email: investorrelations@interpipeline.com

Tel: 403-290-6015 or 1-866-716-7473

Media Relations:

Steven Noble

Manager, Corporate Communications

Email: mediarelations@interpipeline.com

Tel: 403-717-5725

Disclaimer

Certain information contained herein may constitute forward-looking statements that involve risks and uncertainties. Readers are cautioned not to place undue reliance on forward-looking statements, including, but not limited to, statements regarding the reorganization maximizing operational efficiencies; the objective to maximize the value of Inter Pipeline’s petroleum, petrochemical, olefinic and paraffinic products while reducing the volatility associated with market-based product sales; Inter Pipeline’s new ventures business segment focus on the development of large-scale innovative projects to create new cash flow streams, while better serving Inter Pipeline customers through enhanced services or market access; and HPC’s impact on greenhouse gas emissions. Factors that could cause actual results to vary from forward-looking statements or may affect the operations, performance, development and results of Inter Pipeline’s businesses include, among other things, risks and assumptions associated with operations, such as Inter Pipeline’s ability to successfully implement its strategic initiatives and achieve expected benefits therefrom, including: the further development of its projects and facilities; assumptions concerning operational reliability; the potential delays of and increased costs of construction projects (including HPC) and future expansions of Inter Pipeline’s assets; the realization of the anticipated benefits of acquisitions and other projects Inter Pipeline is developing; the timing, financing and completion of acquisitions, transactions or other projects Inter Pipeline is pursuing; risks inherent in Inter Pipeline’s Canadian and foreign operations; risks associated with the failure to finalize formal agreements with counterparties in circumstances where letters of intent or similar agreements have been executed and announced by Inter Pipeline; Inter Pipeline’s ability to generate sufficient cash flow from operations to meet its current and future obligations; Inter Pipeline’s ability to maintain its current level of cash dividends to its shareholders; Inter Pipeline’s ability to access sources of debt and equity capital; Inter Pipeline’s ability to make capital investments and the amounts of capital investments; Inter Pipeline’s ability to maintain its credit ratings; the availability and price of labour, equipment and construction materials; the status, credit risk and continued existence of counterparties having contracts with Inter Pipeline and its affiliates and their performance of such contracts; competitive factors, pricing pressures and supply and demand in the oil and gas transportation, natural gas liquids processing and bulk liquid storage industries; increases in maintenance, operating or financing costs; availability of adequate levels of insurance; difficulty in obtaining necessary regulatory approvals or land access rights and maintenance of support of such approvals and rights; risks of war, hostilities, civil insurrection, instability and political and economic conditions in or affecting countries in which Inter Pipeline and its affiliates operate; severe weather conditions and risks related to climate change; terrorist threats; risks associated with technology and cyber security; availability of energy commodities; volatility of and assumptions regarding prices of energy commodities; fluctuations in currency and interest rates; changes in laws and regulations, including environmental, regulatory and taxation laws, and the interpretation of such changes to Inter Pipeline’s business; the risks associated with existing and potential or threatened future lawsuits and regulatory actions against Inter Pipeline and its affiliates; general economic and business conditions; the effects and impacts of the COVID-19 pandemic as further described in Inter Pipeline’s reports and filings, the extent and duration of which are uncertain at this time, on Inter Pipeline’s business and general economic and business conditions and markets, and such other risk factors, assumptions and uncertainties described from time to time in Inter Pipeline’s reports and filings with the Canadian securities regulatory authorities including in the Circular and in Inter Pipeline’s most recent MD&A and Annual Information Form, and other documents it files from time to time. You can find these documents by referring to Inter Pipeline’s profile on SEDAR (www.sedar.com). Such information, although considered reasonable by Inter Pipeline at the time of preparation, may later prove to be incorrect and actual results may differ materially from those anticipated in the statements made. For this purpose, any statements that are not statements of historical fact are deemed to be forward-looking statements. The forward-looking statements contained in this news release are made as of the date of this news release, and, except to the extent required by applicable law, Inter Pipeline assumes no obligation to update or revise forward-looking statements made herein or otherwise, whether as a result of new information, future events, or otherwise. The forward-looking statements contained in this news release are expressly qualified by this cautionary note.

SOURCE Inter Pipeline Ltd.